Where to Invest: Stocks, Bonds, Gold, or Real Estate? 30-Years of...

My research shows real 30-year investment returns. The Nasdaq 100 leads with a 13.10% return, followed by the S&P 500 at 8.20%, while corporate bonds (7.20%), gold (6.80%), US Treasury bonds (4.90%), and real estate (4.80%) offer progressively lower returns.

5 Timeless Investment Strategies To Make Money in Stocks

I've found that successful stock investing typically follows one of five proven strategies: long-term ETF investing, value stock selection, growth stock portfolios, dividend investing, or active trading.

Top US Defensive Stocks & ETFs to Shield Your Portfolio Now

Defensive stocks are a smart choice if you're worried about your money during tough economic times. They might not outperform the market during boom times, but they can help keep your savings steady when other stocks are falling.

CAN SLIM Strategy Falls Short: Here’s Better Alternatives

Three academic studies suggest that the CAN SLIM strategy can be profitable and outperform the market. However, my real-world research shows that all CANSLIM or IBD-based mutual funds have failed or underperformed versus the market.

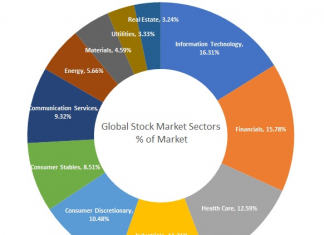

The Truth About Sector Rotation for Individual Investors

I have analyzed multiple sector rotation ETFs, and they indicate that the strategy underperformed the S&P 500. For example, the SPDR SSGA U.S. Sector Rotation ETF has gained only 54% over the last 5 years compared to the S&P 500's 79%.

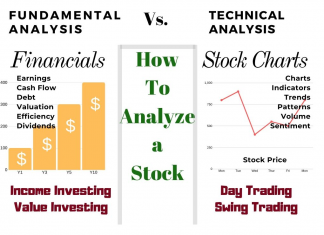

Master Stock Analysis: Fundamental & Technical Insights

I use two main approaches when analyzing stocks. The first is fundamental analysis, which examines key financial metrics like the price-to-earnings ratio, earnings growth,...

Proven Tactics for Superior Stock Research

To research stocks well, I look at a company's financial health, what's happening in their industry, and their potential for future growth. I pay close attention to changes in financials, business operations, and industry trends.

3 Ways to Spot High-Yield Dividend Stocks

Creating a high dividend yield stock screener can help investors pursue investments that generate reliable income. I’ll guide you through creating your stock screener and...

Using Dividend Yield To Grow Your Wealth Faster

Stock market volatility creates opportunities for boosting dividend yields. When prices drop during market panics, yields go up since you're getting the same dividend payout for a lower stock price.

5 Steps to Identify Winning Dividend Stocks

Look for companies with at least 10 years of dividend increases, sustainable payout ratios, and healthy sales growth. It's also important to buy these stocks at a good value.